Examine This Report on Real Estate Taxes Florida

Table of ContentsWhat Does Real Estate Taxes Florida Do?The smart Trick of Real Estate Taxes Florida That Nobody is DiscussingGet This Report about Real Estate Taxes FloridaSome Of Real Estate Taxes FloridaThe 9-Minute Rule for Real Estate Taxes Florida5 Easy Facts About Real Estate Taxes Florida DescribedThe smart Trick of Real Estate Taxes Florida That Nobody is Discussing

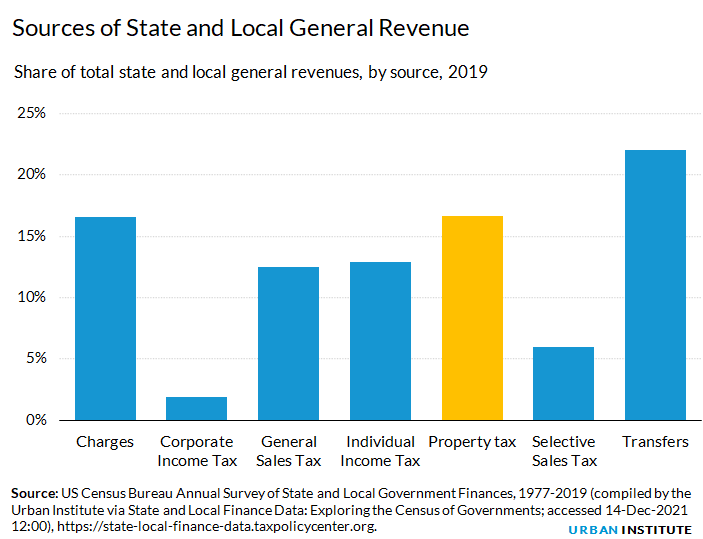

Home taxes are the economic backbone of local federal governments. They represent almost three-quarters of local tax obligation collections and also are a substantial local earnings resource for financing K12 education and learning, authorities and also fire departments, parks, as well as various other services. Real estate tax additionally form neighborhood real estate markets by affecting the prices of buying, renting out, or buying residences and also apartment structures.Residential or commercial property taxes are an extremely fundamental part of homeownership. Property owners can either have the taxes included to their home loan statements that the lending institution deposits in an escrow account or they can pay them independently yet it is very important to pay them. Federal governments evaluate real estate tax based upon place and also value. Building taxes paid by home owners are utilized by regions as well as states to provide crucial services and facilities such as authorities solutions, fire solutions, schools, roadways as well as freeway construction, and various other uses that differ by jurisdiction.

Below is a graph with census information from 2017, that shows building taxes and exactly how much they make up the percentage of state profits. We can see which specifies depend a lot more on property tax obligations than others. Alabama, Delaware, New Mexico, Hawaii, Arkansas are the top 5 states with the most affordable percent to profits.

Rumored Buzz on Real Estate Taxes Florida

These certificates are bid on, either by proposal down auction where the rate of interest is reduced per quote or a premium proposal or bid up where the winner is the greatest bidder. Individuals that intend to invest their money have spent for the certification because the passion enforced on the unsettled tax obligation is now gotten by the investor as opposed to the city government.

10 Easy Facts About Real Estate Taxes Florida Described

Those that desire to foreclose will certainly require to likewise create a deed application that brings a charge as low as $39 yet can be up to $875 in some states yet differs per state. If the foreclosure procedure is total then the investor would certainly have the ability to obtain a property cost-free and also clear just for the charges paid in taxes which would certainly be a terrific investment.

The lesson for home owners: make certain you keep present on your home tax settlements since of the steep rate of interest that accumulate when the state markets your tax obligation lien. real estate taxes florida. As a house owner it is essential to be vigilant in paying your real estate tax to care for your property as well as avoid paying more in rate of interest on overdue taxes.

The 25-Second Trick For Real Estate Taxes Florida

Real estate tax is a tax paid on building owned by a private or other legal entity, such as a corporation. Many typically, building tax obligation is a property ad-valorem tax, which can be considered a regressive tax. It is determined by a local government where the home lies and also paid by the proprietor of the residential property.

Several jurisdictions likewise tax substantial personal residential or commercial property, such as automobiles as well as boats. The try this site local controling body will make use of the analyzed taxes to fund water as well as sewage system improvements, and supply legislation enforcement, fire protection, education and learning, roadway and also highway building and construction, collections, and also various other solutions that benefit the neighborhood. Deeds of reconveyance do not engage with real estate tax.

Property tax obligation is based on the value of the building, which can be property orin many jurisdictionsalso tangible personal effects. Improvements in water as well as drain use the evaluated taxes. Property tax obligation prices and also the kinds of real estate tax vary by jurisdiction. When acquiring a residential property, it is vital to look at the applicable tax regulations.

Get This Report about Real Estate Taxes Florida

However, the rate in the USA is considerably greater than in many European countries. Many empiricists as well as experts have required a rise in home tax obligation rates in created economic situations. They suggest that the predictability as well as market-correcting personality of the tax obligation motivates both stability and appropriate growth of the real estate.

In some locations, the tax assessor might be an elected official. The assessor will certainly designate real estate tax to owners based on present fair market price. This value ends up being the examined worth for the home. The settlement timetable of real estate tax varies by region. In nearly all regional real estate tax codes, there are devices through which the proprietor can discuss their tax obligation price with the assessor or formally object to the price.

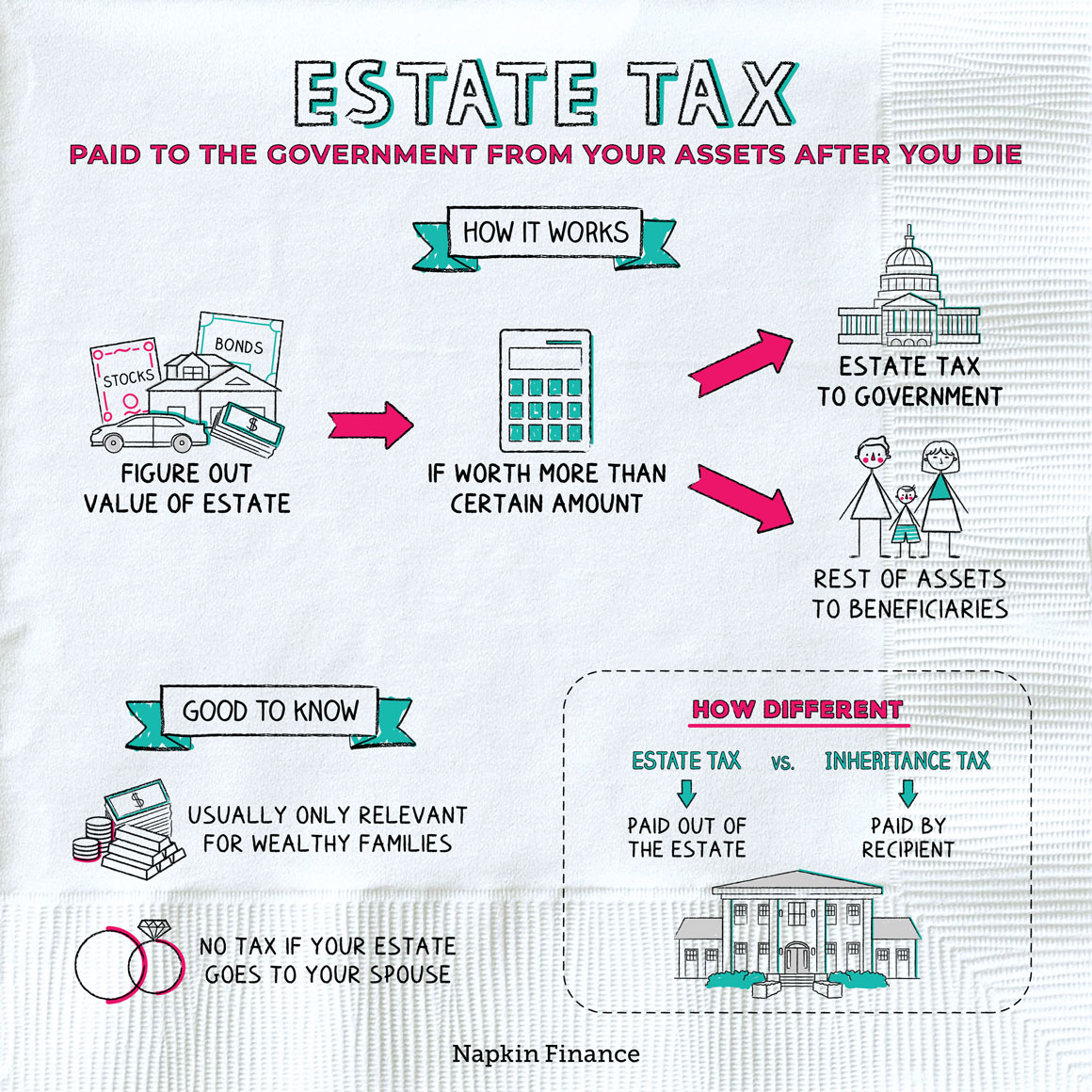

Individuals commonly utilize the terms home tax and also real estate tax obligation reciprocally. And it's partially real: Actual estate tax obligation is a residential property tax obligation.

Unknown Facts About Real Estate Taxes Florida

Below's the difference: Genuine estate taxes are taxes on actual residential property only; property tax obligations can consist of both genuine home as well as substantial individual residential property (real estate taxes florida).

When a home is presently being leased, it creates a stream of monthly lease repayments. Some homes may have extra repayments connected with them, such as for washers and dryers, storage, and also i was reading this car park. Depending upon the offsetting cash money outflows for home loan settlements, building tax obligations, maintenance, etc, the internet cash inflows might be substantial.

Currently, the depreciation duration for property realty is 27 years, while the depreciation duration for business buildings is 39 years. Depending on the location, realty tends to appreciate depending useful reference on regional need degrees. This can vary substantially within also a short distance, yet if you select home meticulously, it can value rather significantly over a long duration of time.

Get This Report about Real Estate Taxes Florida

Ongoing boosts in inflation have a tendency to reduce right into the profits generated from a lot of kinds of investment. This has actually historically not held true for real estate, which tends to value at a price faster than inflation. Component of the factor for this is that investors see realty as a bush versus rising cost of living, as well as so are much more most likely to bid up its price when rising cost of living is high.